For example, you might know that you’ll need to purchase new furniture as your employees come back to the office.

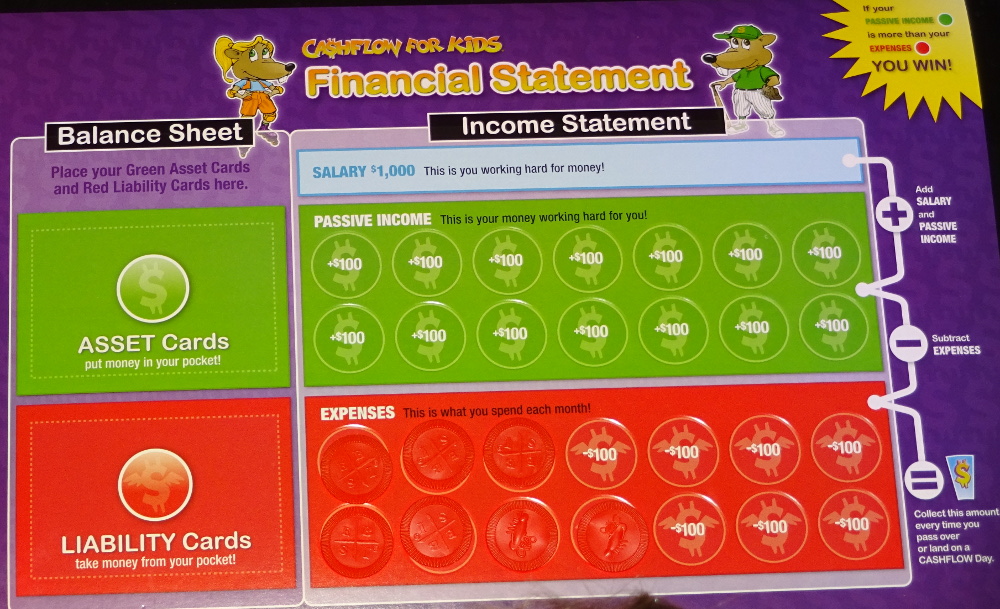

#Cashflow game balance sheet guide manual#

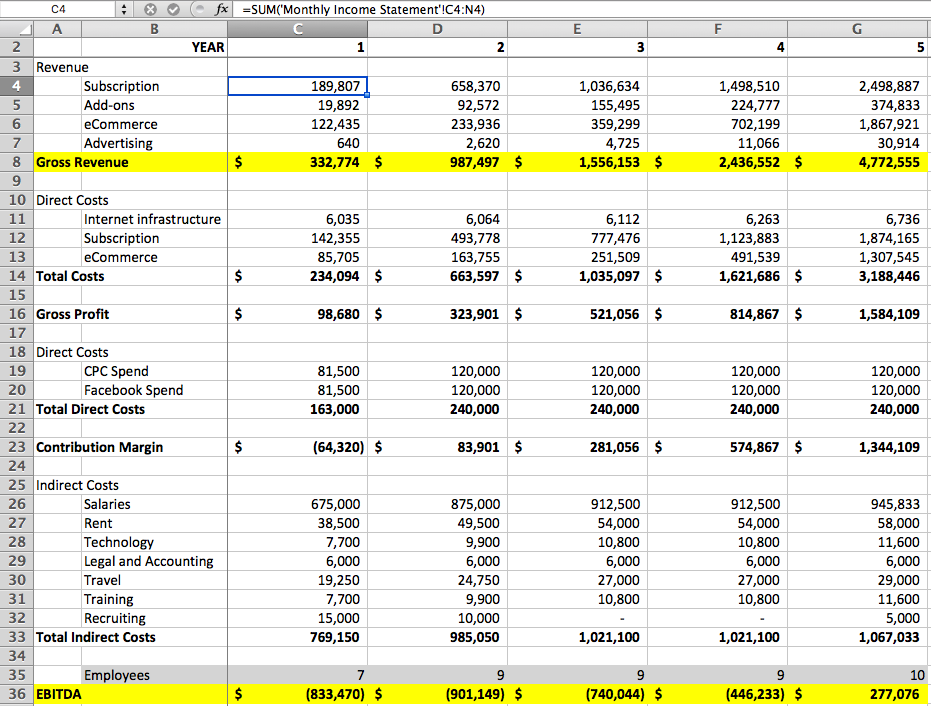

You can also use a manual forecast method to project one-off asset purchases. Then, the next step would be to forecast the depreciation and amortization on a per month basis from the balances you create with incremental headcount hires. If your headcount plans tie into your balance sheet, you’ll be able to see a balance sheet projection that automatically increases according to hiring expectations and capital expenditures. You can see an example of this process in the image below. To project that asset account accurately, you should forecast on a per-head basis. And you can assume that you’ll have to purchase a new laptop (~$2,000) for every new hire you bring on. You can use last period’s balance as a starting point for your forecast. The asset account you use to purchase employee computers is a good example of this process. Because the balance sheet is cumulative, rolling balances forward allows you to see how individual accounts change over time and impact your cash position.

Start your forecast by rolling forward account balances from the previous period. Roll Forward Balances and Choose Your Forecast Methods

There are too many other tasks on your plate to keep up with the tedious, manual process of making sure all the financial data in a granular rolling forecast ties out.īut if you want to get the kind of precision in cash planning that enables you to make better, more strategic decisions, forecasting at the account level is a must.įollow these four steps to go a step beyond basic balance sheet projections. The deeper you try to get with balance sheet forecasting, the harder it becomes to build and maintain in spreadsheets. But the best finance and accounting teams go so much deeper with their balance sheet forecasts. This “financial modeling 101” overview is important to understand. Using balance sheet insights to finish depreciation, interest, and taxes on the income statement.Planning the balance sheet aside from retained earnings.Forecasting your income statement except for depreciation and interest expenses.And some basic financial modeling overviews will tell you to project the line items by: These main line items give you visibility into your net working capital.

Common and preferred stock balances and other shareholder capital accounts and retained earnings. Balances for accounts payable and other liabilities like deferred revenue, taxes, and long-term debt/loans payable.

0 kommentar(er)

0 kommentar(er)